boulder co sales tax rate 2020

County of Boulder 0985 Sales Tax Use tax on Building Materials and Motor Vehicles Open Space 0475 0125 ending 123134 010 ending. 2055 lower than the maximum sales tax in CO.

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Commercial Industrial Personal Vacant Land or State Assessed Property.

. The 2020 Boulder County sales and use tax rate is 0985. Fast Easy Tax Solutions. The minimum combined 2022 sales tax rate for Boulder County Colorado is.

Determining the increase in base revenue can be. Effective July 1 2022. What is the sales tax rate in Boulder Colorado.

Ad Find Out Sales Tax Rates For Free. This rate includes any state county city and local sales taxes. What is the sales tax rate in Boulder County.

Boulder County does not issue licenses for sales tax as the county sales tax is collected by the Colorado. 796 for residential proportion 29 for. Behavioral Health - 25.

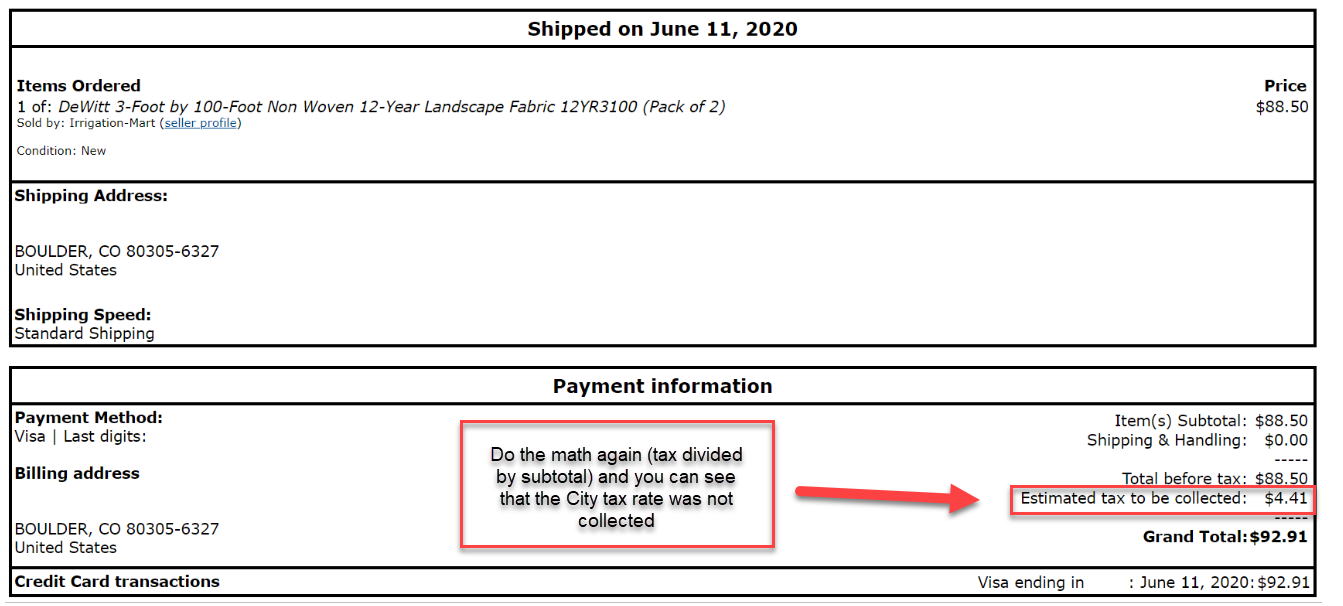

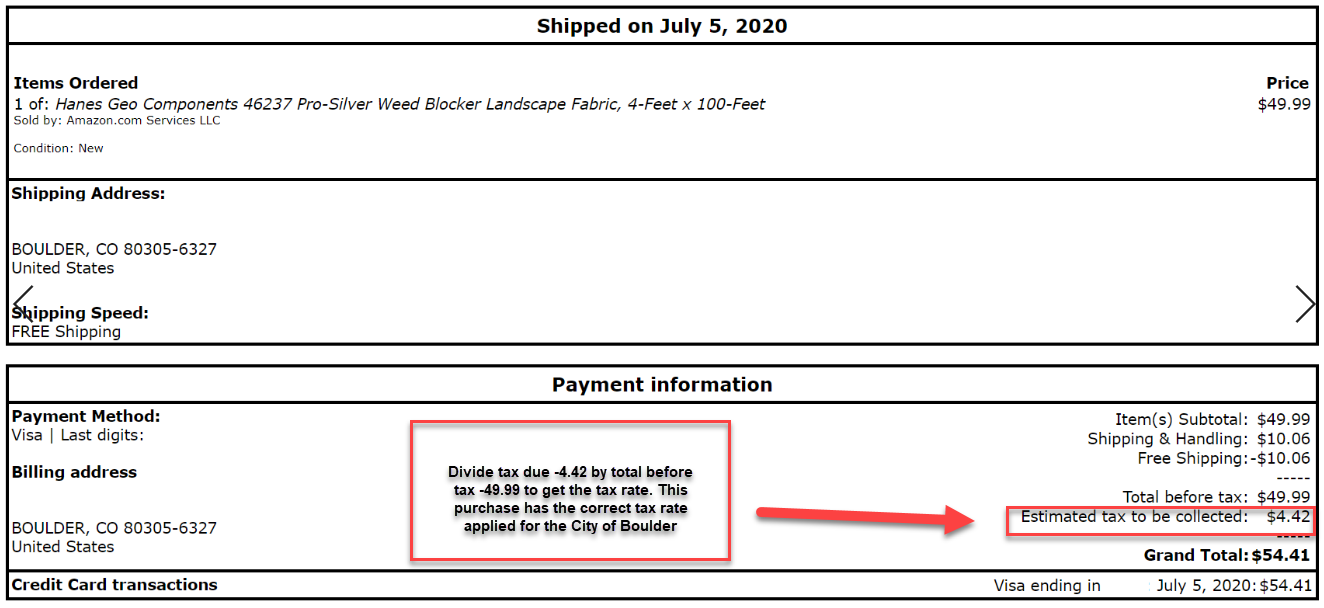

2020 rates included for use while preparing your income tax deduction. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and. The Boulder County Remainder Colorado sales tax is 499 consisting of 290 Colorado state sales tax and 209 Boulder County Remainder local sales taxesThe local sales tax consists.

The Boulder County Sales Tax is 0985. Mobile Home Tax Lien Sale. Our tax lien sale will be held November 18 2022.

Ad Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100. Boulder Sales Tax Rates for 2022. Ad Find Out Sales Tax Rates For Free.

Fast Easy Tax Solutions. Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle. Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022.

The latest sales tax rate for Boulder County CO. Boulder in Colorado has a tax rate of 885 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Boulder totaling. The December 2020 total local sales tax rate was also 4985.

This rate includes any state county city and local sales taxes. Storing using or consuming in. Microsoft Word - 2020 Sales Tax.

Jail Operations - 15. Fairgrounds The Ranch - 15. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985.

Use tax is levied in the following circumstances. July to December 2020. This document lists the sales and use tax rates for all Colorado cities counties and special districts.

A county-wide sales tax rate of 0985 is applicable to localities in Boulder County in addition to the 29 Colorado sales tax. Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax Boulder Countys Sales. The latest sales tax rate for Boulder CO.

The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. If a vehicle is purchased from a.

This is the total of state and county sales tax rates. Residential fluctuates from year-to-year 796. Open Space - 25.

BOULDER COUNTY USE TAX For 2020 Boulder County collects use tax at the rate of 0985. About City of Boulders Sales and Use Tax. Boulder County CO Sales Tax Rate.

The minimum combined 2022 sales tax rate for Boulder Colorado is. It also contains contact information for all self. Method to calculate Boulder sales tax in 2021.

The Department of Revenue will update both the DR0100 Retail Sales. Higher sales tax than 89 of Colorado localities. Our tax lien sale will be held December 2 2022.

Some cities and local. 2020 rates included for use while preparing your income tax deduction. As permitted under CRS 39-10-1115 delinquent.

This is the total of state county and city sales tax rates.

Sales And Use Tax City Of Boulder

Colorado Sales Tax Rates By City County 2022

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

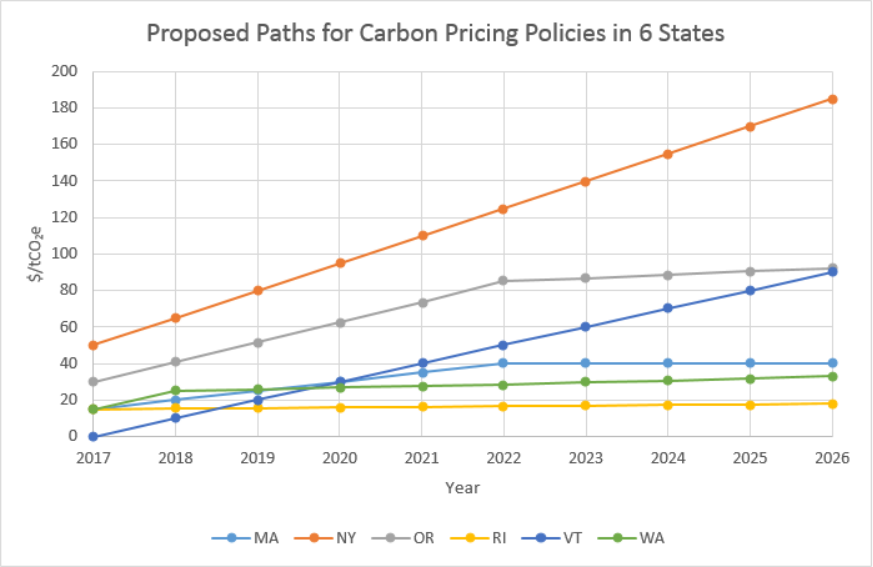

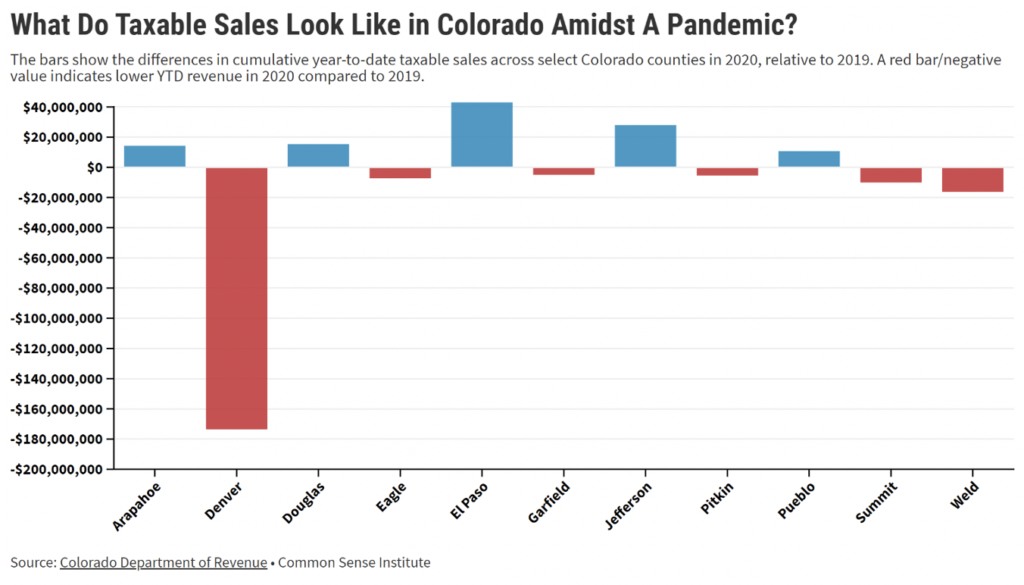

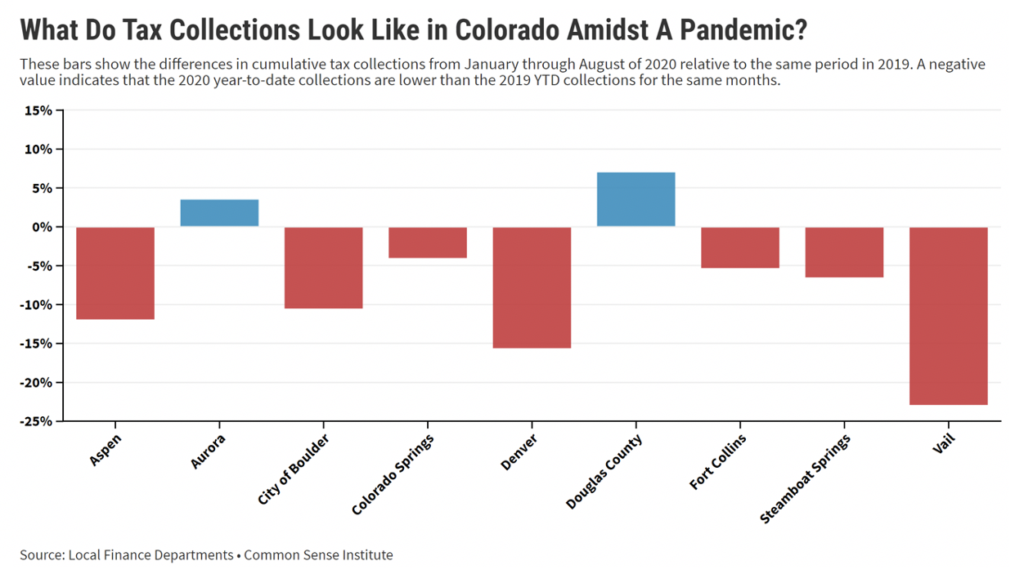

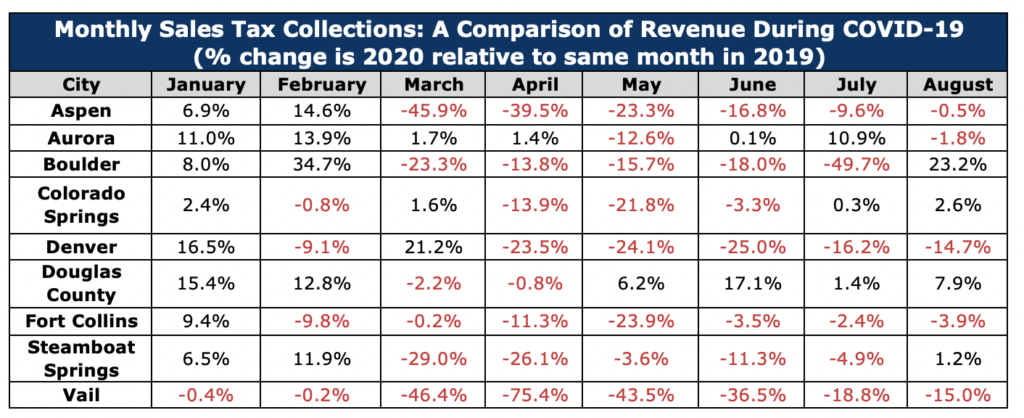

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Windsor Property Tax 2021 Calculator Rates Wowa Ca

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

California Sales Tax Rates By City County 2022

File Sales Tax By County Webp Wikimedia Commons

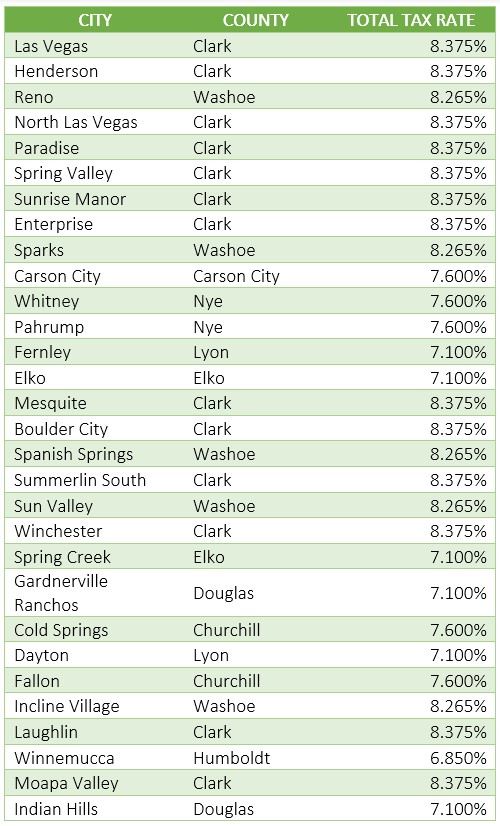

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Nevada Income Tax Calculator Smartasset

Wyoming Sales Tax Rates By City County 2022

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute